Key Takeaways

• Nvidia’s earnings confirm that AI demand remains extremely strong

• Data center revenue is now the core growth engine

• Stock reaction shows markets expect continued hyper growth

• Indian IT and semiconductor themes may see indirect impact

• Investors should track AI capex trends closely

Nvidia Becomes the AI Barometer for Global Tech

The latest results from Nvidia have once again reinforced its position as the most closely watched company in the artificial intelligence ecosystem. When Nvidia reports earnings, global markets treat it as a real time health check of AI demand.

The company delivered strong numbers that beat estimates, yet the stock cooled off after hours. This mixed reaction tells an important story. Growth remains powerful, but expectations are now extremely high.

For investors in India and abroad, understanding what Nvidia’s results signal can help decode the next phase of the technology cycle.

Why Nvidia Is Called the AI Barometer

Over the past two years, Nvidia has transformed from a graphics chip company into the backbone of the AI revolution. Its GPUs power data centers, cloud providers, and generative AI platforms worldwide.

Today, whenever hyperscalers invest in AI infrastructure, Nvidia is usually one of the biggest beneficiaries. That is why its numbers reflect the broader trend in AI spending.

The latest data makes this clear.

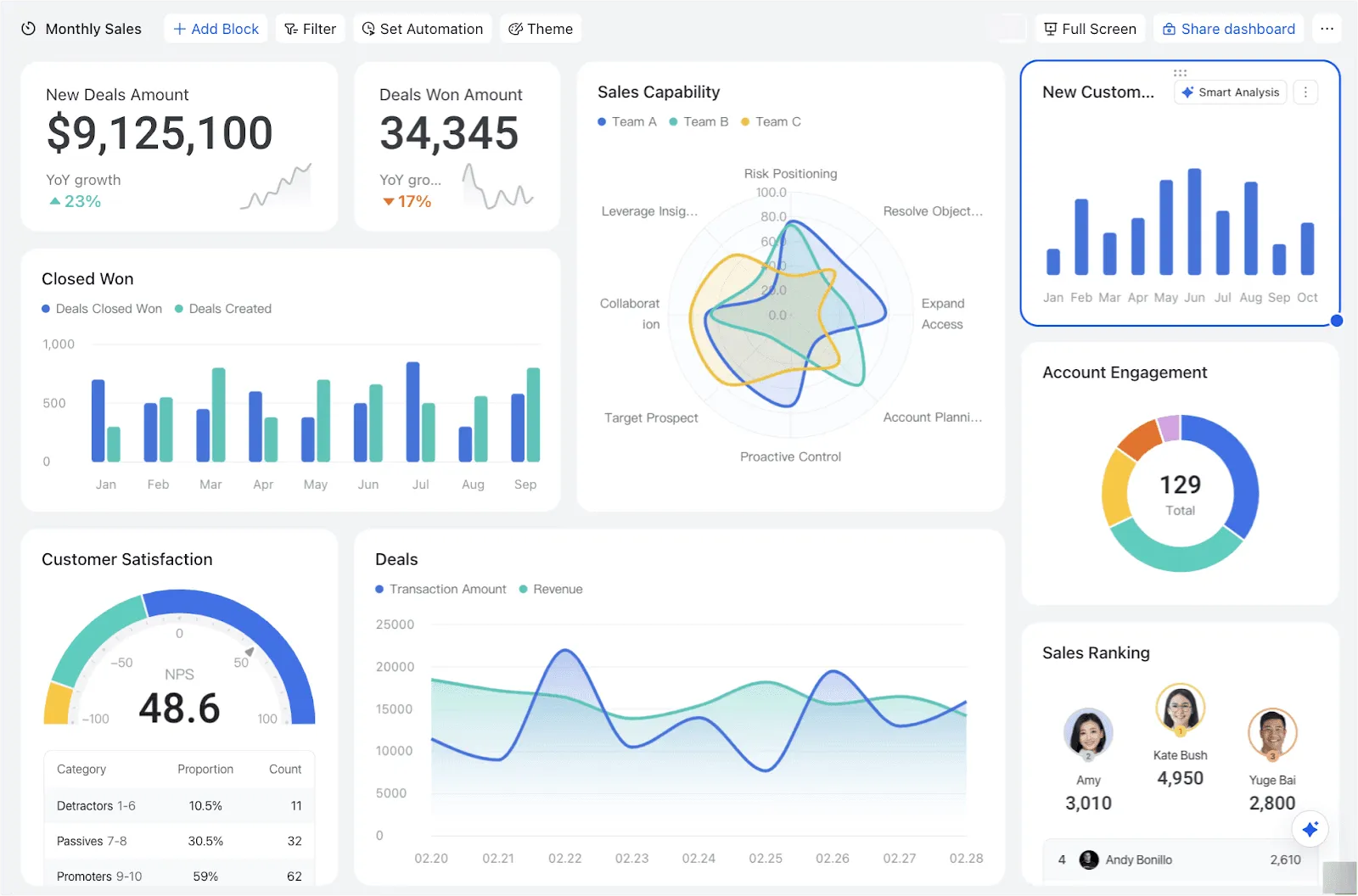

Revenue has expanded dramatically:

• FY23 revenue around 27 billion dollars

• FY24 revenue around 60.9 billion dollars

• FY25 revenue around 131 billion dollars

• FY26 revenue guidance near 215.9 billion dollars

This near eightfold jump in just a few years shows how quickly AI adoption has scaled.

Data Center Business Drives the Story

One of the most important shifts in Nvidia’s business mix is the dominance of the data center segment.

The data center division now contributes about 91 percent of total revenue. Before the AI boom in 2023, this figure was close to 55 percent.

This change highlights a structural transformation rather than a temporary spike.

What does this mean in simple terms?

Earlier, Nvidia was largely dependent on gaming GPUs. Today, its fortunes are tied to enterprise AI spending, cloud infrastructure, and large language model training.

As long as Big Tech continues heavy AI investments, Nvidia’s growth momentum is likely to remain strong.

Strong Numbers but Stock Reaction Matters

Despite beating estimates, Nvidia shares cooled off in after hours trading after initially rising about 3 percent.

This reaction is important for investors to understand.

Markets are forward looking. When expectations become extremely high, even strong results may not lead to sustained stock rallies. Investors are now asking tougher questions:

• Can this growth pace continue

• Is AI capex peaking

• What happens if cloud spending slows

The company’s Q1 revenue guidance of about 78 billion dollars implies roughly 77 percent year on year growth, which is still very strong. However, the market is becoming more sensitive to any signs of moderation.

Global Tech Sector Implications

Nvidia’s performance has ripple effects across the entire technology ecosystem.

Positive signals

If Nvidia continues to report strong demand, it suggests:

• Hyperscalers are still investing aggressively

• AI infrastructure buildout is ongoing

• Semiconductor cycle remains in expansion

Caution signals

However, the stock’s muted reaction shows:

• Valuations are already pricing in strong growth

• Any slowdown could trigger sharp corrections

• AI optimism is now consensus rather than contrarian

This phase often leads to higher volatility in global tech stocks.

Impact on Indian Markets

Indian markets do not have a direct Nvidia equivalent, but the AI boom still has meaningful implications.

Indian IT services

Companies like TCS, Infosys, and HCLTech are increasingly positioning themselves around AI led digital transformation. Strong global AI spending usually translates into higher deal pipelines for these firms.

Semiconductor and electronics ecosystem

India’s push under the Semiconductor Mission and electronics manufacturing incentives could benefit from sustained global demand for chips and AI hardware.

Market sentiment

Nvidia results often influence Nasdaq movement, which in turn affects risk appetite in emerging markets including India. Strong US tech momentum usually supports FII flows into Indian equities.

What Indian Investors Should Watch Next

Going forward, investors should focus on a few key indicators.

• AI capex commentary from hyperscalers

• Cloud spending trends

• Data center capacity expansion globally

• US Federal Reserve policy stance

• Semiconductor supply chain developments

These factors will determine whether the AI boom sustains its current pace.

Risk Factors to Keep in Mind

While the AI story remains powerful, some risks cannot be ignored.

Export restrictions, especially related to China, could affect future growth assumptions. The latest guidance already assumes zero China sales, which the market is watching closely.

Valuation risk is another key factor. When companies grow this fast, expectations can become stretched, making stocks vulnerable to sharp corrections.

Finally, any slowdown in enterprise AI adoption or cloud capex could quickly change sentiment.

How Swastika Investmart Helps Investors Navigate Such Trends

In a fast evolving technology cycle, timely research and disciplined investing become critical.

Swastika Investmart, a SEBI registered broker, supports investors with:

• Robust research backed insights

• Advanced trading platforms

• Dedicated customer support

• Investor education initiatives

• Tech enabled investing experience

Conclusion

Nvidia has firmly established itself as the AI barometer for global technology markets. The latest results confirm that AI demand remains strong, but the cooling stock reaction shows that expectations are now extremely elevated.

For Indian investors, the takeaway is clear. The AI wave is real and powerful, but markets are entering a more selective phase. Tracking global tech signals, valuation comfort, and capital spending trends will be crucial in the coming quarters.

Staying informed and disciplined will matter more than ever.

Frequently Asked Questions

What does it mean that Nvidia is an AI barometer

It means Nvidia’s performance reflects the overall health of AI demand and data center spending across the global technology sector.

Why did Nvidia stock cool off despite strong results

Because market expectations were already very high. Even strong earnings may not move the stock much when growth is fully priced in.

How does Nvidia impact Indian markets

Strong Nvidia performance often boosts global tech sentiment, which can indirectly support Indian IT stocks and FII flows.

Is the AI boom slowing down

Current data suggests AI demand remains strong, but markets are closely watching for any signs of moderation in capex.

Should Indian investors track global tech earnings

Yes. Global technology trends often influence market sentiment, sector rotation, and investment flows in India.

4

The Shree Ram Twistex IPO Review is attracting investor attention because it combines two themes markets like right now: manufacturing growth and renewable energy integration. Textile companies are cyclical by nature, but firms that reduce costs through captive power often gain a competitive edge.

So the key question investors are asking is simple. Is this IPO worth subscribing to, or should you stay cautious?

Let’s examine the fundamentals, valuation, risks, and outlook in detail.

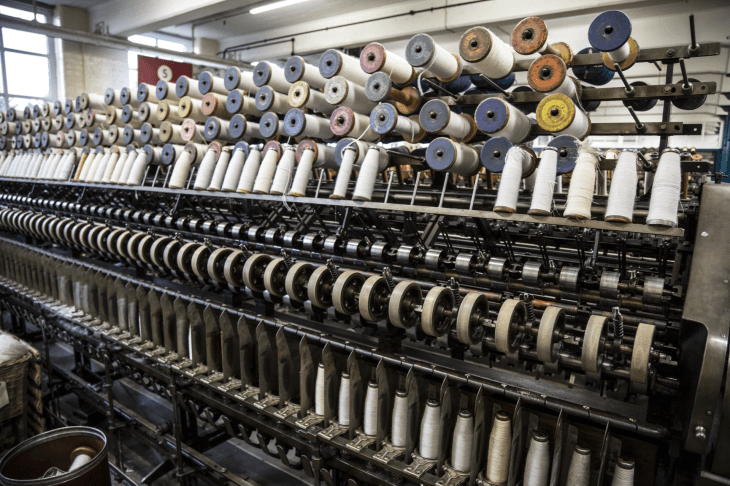

Shree Ram Twistex Limited is a Gujarat based cotton yarn manufacturer incorporated in 2013. It operates a manufacturing facility in Gondal, Rajkot and produces compact ring spun yarn and carded yarn in both combed and carded varieties.

Its product portfolio also includes value added yarn such as Eli Twist yarn, compact slub yarn, and Lycra blended yarn used in denim, towels, shirting, home textiles, and industrial fabrics.

The company primarily follows a B2B model supplying institutional buyers including textile manufacturers and garment exporters.

Here are the key issue facts explained simply:

Allocation breakup

Lower retail allocation often means limited listing liquidity for individual investors.

The company’s numbers show steady growth:

Margins are modest because textile manufacturing is a competitive, price sensitive industry. Still, steady improvement signals better cost control and operational discipline.

A major highlight of this IPO is the company’s plan to invest in renewable power for captive consumption:

Electricity is one of the biggest costs for spinning mills. By generating its own power, the company could reduce operating expenses and protect margins from energy price volatility.

For example, several textile companies that installed captive renewable power have historically reported better cost stability during periods of rising electricity tariffs. If executed efficiently, this strategy can strengthen profitability over time.

Scale expansion

Production capacity has increased to about 9,855 MT per annum, improving efficiency and cost leverage.

Operational track record

The company reports no history of strikes, lockouts, or major disruptions.

Experienced promoters

Management has strong textile industry experience, which is crucial in a cyclical sector.

No accumulated losses

This indicates financial stability and disciplined capital management.

No IPO is risk free, especially in manufacturing.

Customer concentration risk

The company depends heavily on a few large customers for revenue.

No long term contracts

Orders are received on a purchase order basis, which reduces revenue visibility.

No dividend history

The company has not declared dividends in the past and does not have a formal dividend policy.

Technology upgrade risk

Textile machinery requires periodic upgrades, which can increase capital expenditure.

The IPO is valued at roughly 29 to 30 times earnings.

Its pre IPO EPS stands at ₹2.72 with a P/E near 38.21.

Compared with listed textile companies such as Ambika Cotton Mills Limited, Damodar Industries Limited, and Rajapalayam Mills Limited, the valuation appears relatively expensive.

This suggests that much of the expected growth is already factored into the issue price.

The textile sector in India is highly cyclical and influenced by global demand, cotton prices, and export trends. When global apparel demand slows, spinning mills often face pricing pressure.

However, companies that focus on efficiency and energy optimization tend to outperform peers during downturns. Shree Ram Twistex’s renewable energy strategy could help it stand out if execution remains strong.

This IPO may be suitable for:

It may not suit conservative investors or those seeking quick listing gains because the valuation leaves limited margin of safety.

The Shree Ram Twistex IPO Review indicates a cautious stance.

Positives

Concerns

Overall view: Avoid for conservative or short term investors. Consider only if you have a long term horizon and high risk appetite.

Is Shree Ram Twistex IPO good for listing gains?

It appears unlikely because the valuation already factors in future growth expectations.

What is the minimum investment amount?

One lot of 144 shares at ₹104 equals about ₹14,976.

What makes this IPO unique?

Its plan to install captive solar and wind power plants to reduce costs.

Is the company profitable?

Yes. Net profit increased steadily to ₹8 crore in FY25.

What is the biggest risk?

Dependence on a few customers and lack of long term contracts.

Shree Ram Twistex presents an interesting story of a traditional textile manufacturer evolving into a more efficient, energy optimized business. While fundamentals show improvement, valuation leaves little room for error. Investors should approach carefully and align decisions with their risk tolerance.

For detailed IPO analysis, advanced research tools, and seamless investing experience, Swastika Investmart Limited offers a reliable platform backed by SEBI registration, powerful analytics, strong customer support, and investor education resources.

4

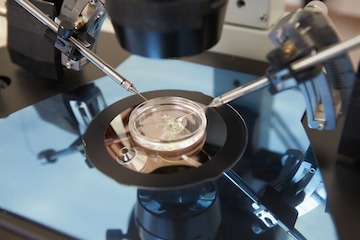

The Gaudium IVF & Women Health IPO Review is gaining attention among investors looking for niche healthcare listings. India’s fertility services industry is expanding quickly due to rising infertility awareness, delayed parenthood, and improving affordability. Companies operating in specialized healthcare segments often command premium valuations because of strong margins and entry barriers.

But does this IPO truly deserve a place in your portfolio, or is it priced too aggressively? Let’s break down everything investors should know before applying.

Gaudium IVF & Women Health Limited operates in assisted reproductive technology services, offering treatments such as IVF, ICSI, and IUI. The company has built a pan India presence with more than 30 centers structured through a hub-and-spoke model, allowing centralized expertise while expanding reach efficiently.

Founded by fertility specialist Dr. Manika Khanna, the company positions itself as a specialized fertility brand with standardized clinical protocols and stage wise treatment processes.

Unlike diversified hospital chains, Gaudium focuses only on fertility care, giving it a niche identity and operational specialization.

Here are the key IPO details explained simply:

Reservation structure

The company has demonstrated strong growth over the last three financial years.

A major highlight is profit growth of about 85 percent year on year in FY25, showing operational leverage as the company scales.

High margins near 40 percent are uncommon in healthcare services and indicate strong pricing power and efficient cost control.

IPO proceeds will be used for:

Expansion funding is often viewed positively because it supports revenue visibility. However, debt repayment suggests previous capital intensity.

Interestingly, there are no direct listed peers in India operating purely in fertility services.

For comparison, international players include:

This lack of domestic peers gives Gaudium a scarcity premium. Investors often pay higher multiples for companies operating in underrepresented sectors on stock exchanges.

Strong clinical expertise

Specialist driven fertility treatment enhances success rates and builds patient trust.

Scalable expansion model

The hub-and-spoke strategy allows rapid geographic growth without proportionate cost escalation.

Digital adoption

Telemedicine and lab automation improve operational efficiency and patient reach.

Growing market opportunity

India’s fertility industry is expanding quickly due to rising infertility rates, lifestyle changes, and increasing awareness.

Every IPO carries uncertainties, and this one is no exception.

Tax dispute

The company faces a ₹31 crore tax dispute, which could affect earnings visibility if unfavorable outcomes occur.

Dependence on skilled professionals

Fertility treatment success depends heavily on experienced doctors and embryologists. High attrition could impact operations.

Healthcare sector risks

Litigation, regulatory scrutiny, and compliance requirements are inherent to medical businesses.

Past cash flow pressure

Historical negative cash flows and rising borrowings could affect financial flexibility.

At the upper band price of ₹79, the IPO is valued at around 28–30 times FY25 earnings.

For context, this valuation is considered premium for a small healthcare company. However, investors often accept higher multiples for niche healthcare leaders with high margins and strong growth visibility.

Its pre IPO EPS stands at ₹3.12 with a post issue P/E of about 25.36.

So the valuation debate comes down to one question:

Are you willing to pay a premium today for future growth?

Healthcare IPOs in India have historically attracted strong investor interest, especially when they represent unique segments. Fertility services are still underpenetrated in India compared with developed countries.

If the company executes its expansion well, it could become a dominant listed fertility platform. For investors seeking sector diversification beyond IT, banking, or FMCG, this IPO offers exposure to a niche healthcare theme.

This IPO may suit investors who:

It may not suit short term listing gain seekers because premium valuations can limit upside on debut.

The Gaudium IVF & Women Health IPO Review suggests a balanced outlook.

Positives

Concerns

Overall, the issue appears suitable for investors willing to hold long term rather than those seeking quick gains.

Is Gaudium IVF IPO good for listing gains?

Not ideal. Premium valuation reduces chances of sharp listing upside.

What is the minimum investment amount?

One lot of 189 shares at ₹79 equals about ₹14,931.

Is the company profitable?

Yes. It reported ₹19.13 crore net profit in FY25.

What is the biggest risk?

The ₹31 crore tax dispute and dependence on specialized doctors.

Does it have listed competitors in India?

No. It is currently a rare pure play fertility services listing.

The IPO presents a classic growth versus valuation tradeoff. The business fundamentals are strong, but pricing leaves limited margin of safety. Investors who believe in India’s fertility healthcare growth story may consider subscribing with patience.

For data driven IPO analysis, research backed insights, and seamless investing tools, Swastika Investmart Limited offers a reliable platform backed by SEBI registration, advanced analytics, investor education resources, and responsive support.

India’s artificial intelligence narrative just received a major policy push. At the India AI Impact Summit 2026, Prime Minister Narendra Modi unveiled the MANAV Vision, a framework aimed at making AI ethical, inclusive, and accountable.

For investors and market watchers, the big question is clear: Will this policy momentum translate into real gains for India’s AI and technology stocks?

In this blog, we decode what the MANAV Vision means, which sectors could benefit, and how investors should approach this emerging theme.

• MANAV Vision focuses on ethical, inclusive and sovereign AI development

• Positive long term sentiment for IT services, data centers and digital infrastructure

• No immediate earnings trigger but strong thematic tailwind

• Investors should track AI focused companies and policy execution closely

The MANAV Vision is India’s policy framework to guide the responsible development of artificial intelligence. The government’s intent is to ensure that AI growth remains human centric and does not become concentrated in the hands of a few global players.

MANAV stands for:

• Moral and ethical AI systems

• Accountable governance and transparent rules

• National sovereignty over data

• Accessible and inclusive AI

• Valid and lawful AI deployment

The broader message is simple. India wants AI to scale rapidly, but with strong guardrails around data protection, transparency, and public benefit.

From a stock market perspective, policy direction often shapes long term capital flows. While the MANAV announcement is not an immediate earnings catalyst, it strengthens the structural case for India’s AI ecosystem.

Three key market implications stand out.

Government backing reduces regulatory uncertainty. When policymakers clearly support a technology theme, companies tend to increase investments, partnerships, and capacity building.

We saw a similar trend in the past with digital payments after UPI promotion and with renewables after PLI schemes. AI could follow a comparable trajectory.

India hosting a major AI summit signals intent to become a serious player in the global AI race. This improves investor perception of the country’s technology ecosystem.

Global clients may increasingly view Indian IT firms not just as cost efficient service providers but as AI solution partners.

AI adoption requires heavy investments in:

• Data centers

• Cloud infrastructure

• High performance computing

• Semiconductor ecosystem

Any sustained push in these areas typically benefits multiple listed players across the value chain.

While the impact will be gradual, some segments of the market are better positioned than others.

Large Indian IT companies are already investing heavily in generative AI, automation, and enterprise AI solutions. The MANAV Vision strengthens the long term demand outlook.

Companies offering:

• AI consulting

• cloud migration

• data engineering

• automation platforms

could see improved deal pipelines over time.

However, investors should remember that global tech spending cycles will still drive near term performance.

AI workloads are extremely compute intensive. This directly increases demand for data center capacity and power infrastructure.

India is already witnessing rising announcements in hyperscale data centers. Policy support for AI could accelerate this trend further.

Although India’s semiconductor journey is still evolving, the AI push adds strategic urgency. Over the medium term, companies linked to electronics manufacturing and chip ecosystem development may benefit from policy tailwinds.

A balanced view is important. Not every policy announcement translates into immediate stock market gains.

India has announced several ambitious technology missions in the past. The real impact depends on:

• budget allocation

• private sector participation

• speed of implementation

Investors should track actual project announcements rather than relying only on policy headlines.

Indian IT stocks remain heavily dependent on US and European tech spending. Even with strong domestic AI push, weak global demand can cap near term upside.

Many frontline IT stocks already trade at premium valuations. Any AI driven rerating may take time unless earnings growth accelerates meaningfully.

For long term investors, the AI theme in India is clearly strengthening. However, timing and stock selection remain critical.

A practical approach could be:

• Focus on companies with proven AI capabilities

• Track deal wins and order pipelines, not just announcements

• Avoid chasing momentum after sharp rallies

• Maintain a staggered investment strategy

Remember, structural themes often play out over multiple years, not weeks.

A useful comparison is India’s digital payments story.

When UPI was launched and promoted aggressively, the immediate stock market impact was limited. But over time, companies aligned with the digital ecosystem saw significant rerating as adoption scaled.

AI in India may follow a similar path. Early policy support builds the foundation, but earnings visibility comes gradually.

The MANAV Vision signals that India wants to balance innovation with responsibility. If executed well, this framework could:

• attract global AI investments

• strengthen India’s tech exports

• deepen domestic digital infrastructure

• create new high skill employment

For the stock market, this translates into a positive long term narrative, especially for technology and digital infrastructure players.

However, investors should stay realistic about timelines. The AI opportunity is real, but it will unfold in phases.

PM Modi’s MANAV Vision is an important strategic step in India’s AI journey. While it may not trigger an immediate rally in AI and tech stocks, it clearly strengthens the long term structural story for the sector.

For investors, the key is to track execution, valuations, and company specific fundamentals rather than reacting purely to headlines.

If you are looking to identify strong AI and technology opportunities with research backed insights, having the right platform matters. Swastika Investmart, a SEBI registered broker, offers robust research tools, tech enabled investing platforms, and dedicated customer support to help investors make informed decisions.

Is the MANAV Vision immediately bullish for IT stocks?

Not immediately. It is a long term positive but near term performance will still depend on global tech demand and company earnings.

Which sectors may benefit the most from India’s AI push?

IT services, data centers, cloud infrastructure, and parts of the electronics ecosystem are likely to gain over time.

Should investors buy AI stocks right now?

Investors should avoid impulsive buying. A staggered approach based on valuations and fundamentals is more prudent.

Does the MANAV Vision include regulation of AI?

Yes. The framework emphasizes ethical AI, accountability, lawful usage, and national data sovereignty.

How can retail investors track AI opportunities?

Monitor company disclosures on AI deals, partnerships, capex plans, and management commentary during earnings calls.

Bharti Airtel has strengthened its ownership in Indus Towers to about 51.22% after acquiring additional shares from the open market. Between February 5 and February 10, 2026, the telecom giant purchased a total of 32.73 lakh shares, including a fresh lot of 20 lakh shares.

This acquisition was not sudden. In November 2025, Airtel’s board approved a plan to increase its stake by up to 5%. The recent purchases fall within that limit, signaling a structured and pre planned strategy rather than opportunistic buying.

Promoter stake increases often draw investor attention because they reflect management’s conviction about future prospects.

Indus Towers operates one of the largest telecom tower portfolios in the country. These towers form the backbone of wireless communication, supporting multiple telecom operators that lease space to install antennas and equipment.

In simple terms, telecom companies compete for customers, but they often share tower infrastructure. This model reduces costs and speeds up network rollout, especially for technologies like 5G.

As data consumption grows across India, demand for tower infrastructure rises. More users streaming video, gaming, or using digital services means operators need stronger networks. Stronger networks require more towers and better coverage.

When promoters buy shares from the market instead of selling, it often indicates confidence in the company’s growth prospects. They usually have deeper insight into operational trends, upcoming contracts, and industry direction.

Increasing ownership strengthens promoter control and aligns management interests with shareholders. Higher stake means promoters benefit directly from value creation.

Investors often track promoter transactions closely. Positive sentiment can emerge if markets interpret the move as a signal of undervaluation or growth potential.

However, share prices do not always rise immediately. Market reaction depends on broader sentiment, sector outlook, and macroeconomic conditions.

As of February 13, 2026, at 2:31 PM, Indus Towers shares were trading around ₹465.95 on NSE, down about 1.70% from the previous close. Short term price movement can be influenced by profit booking, market volatility, or sector rotation rather than company specific fundamentals.

Seasoned investors usually focus less on daily fluctuations and more on structural trends such as earnings growth, contract wins, and debt levels.

Tower companies operate on long term leasing contracts with telecom operators. This provides predictable cash flow compared to many other sectors.

Consider a real world analogy. Owning telecom towers is similar to owning commercial real estate. Instead of retail tenants, tower firms lease space to telecom providers. As long as tenants remain, revenue continues.

India’s telecom sector is still expanding. Rural penetration, 5G rollout, and digital adoption are key drivers. Infrastructure providers stand to benefit from these structural trends.

Increasing stake in a strategic partner can offer several advantages:

Operational synergy

Closer coordination between network rollout and tower deployment can reduce delays.

Cost optimization

Stronger control may help negotiate better infrastructure costs.

Strategic flexibility

Higher ownership gives Airtel greater influence over business decisions and long term planning.

Even positive developments come with uncertainties. Investors should evaluate:

Balanced analysis helps investors avoid reacting emotionally to headlines.

India’s capital markets operate under strict disclosure norms monitored by the Securities and Exchange Board of India. Promoter transactions must be reported, ensuring transparency for investors.

This regulatory framework builds trust because shareholders can verify whether insiders are buying or selling shares. Such transparency is essential for fair market functioning.

Large promoter purchases often improve sentiment across related sectors. Telecom infrastructure companies, equipment suppliers, and network service providers may attract renewed investor interest.

The move also reflects confidence in India’s digital growth story. Rising data consumption, smartphone adoption, and enterprise digitization continue to expand the telecom ecosystem.

Institutional investors frequently track such signals when deciding sector allocations.

Instead of reacting instantly, investors often benefit from structured evaluation:

Using professional research platforms like Swastika Investmart can help investors interpret corporate actions with deeper data insights, advanced tools, and responsive support. Access to structured research makes it easier to separate meaningful signals from market noise.

Why did Bharti Airtel increase its stake in Indus Towers

The purchases align with its earlier board approved plan to raise ownership and strengthen strategic control.

Is promoter buying always bullish

It is often viewed positively, but it should be analyzed alongside fundamentals and sector outlook.

Does this affect telecom sector stocks

Such moves can improve sentiment across telecom and infrastructure stocks, though broader market trends still matter.

Will Indus Towers share price rise immediately

Not necessarily. Short term price movements depend on market sentiment, liquidity, and investor expectations.

Should investors act on this news alone

No. Investment decisions should be based on detailed research, valuation analysis, and financial performance.

Bharti Airtel’s decision to raise its stake to 51.22% in Indus Towers reflects strategic intent rather than short term speculation. It signals confidence in the long term growth of telecom infrastructure, a sector that forms the backbone of India’s digital economy.

For investors, developments like these provide useful clues about where corporate leaders see future value. Tracking such signals with reliable research tools can improve decision making and reduce guesswork.

If you want access to professional grade insights, advanced analytics, and a seamless investing experience, you can begin here:

4

Tata Consultancy Services entering the agentic AI space through collaboration with OpenAI marks a pivotal moment for India’s IT sector. For decades, Indian technology firms built global dominance through outsourcing, application development, and consulting. Now the industry is transitioning into a phase where artificial intelligence systems can independently plan, execute, and optimize business processes.

This is not just another technology partnership. It represents a structural shift in how IT services may be delivered in the future. Instead of billing clients primarily for human effort, companies may increasingly monetize AI driven outcomes.

Traditional automation follows fixed instructions. Agentic AI, by contrast, can interpret goals, make decisions, and perform tasks without constant human supervision. It can manage workflows, coordinate systems, and even adjust strategies based on real time data.

For enterprises, this means software that acts more like a digital employee than a tool.

Imagine a global retailer using agentic AI to manage inventory. Instead of analysts forecasting demand manually, the system could monitor sales trends, supplier timelines, and logistics costs, then automatically place orders and optimize pricing. This level of autonomy reduces costs and improves efficiency simultaneously.

For IT service providers, delivering such capabilities can significantly increase contract value.

Clients today want solutions that reduce operational costs rather than just support processes. AI platforms capable of independent execution directly address this demand. By collaborating early, TCS positions itself as a transformation partner rather than a traditional vendor.

Global technology consulting firms are racing to integrate advanced AI into enterprise systems. Early adoption strengthens brand perception as an innovation leader. That perception matters because enterprise clients prefer partners who demonstrate technological leadership.

India’s IT giants possess large engineering workforces and strong delivery frameworks. This makes them well suited to scale AI driven solutions quickly once platforms mature.

The announcement carries important implications for equity markets and sector sentiment.

Companies that successfully integrate advanced AI capabilities often command higher valuation multiples. Investors tend to reward firms that show strong technological relevance in future growth areas.

Agentic AI could gradually shift revenue structures from time based billing to outcome based pricing. This transition may improve margins over time if execution is efficient.

Markets typically react with excitement to AI announcements, but price movements can fluctuate until investors see measurable financial impact. Quarterly deal wins and pipeline disclosures will be key indicators to watch.

When a market leader moves into a new technology domain, peers often accelerate their own investments. This creates an industry wide innovation cycle.

Possible ripple effects include:

Such developments can strengthen India’s position as a global technology hub.

Artificial intelligence deployment in enterprise environments must comply with evolving data protection and governance standards. In India, market transparency and corporate disclosures are monitored by the Securities and Exchange Board of India, ensuring investors receive accurate information about strategic initiatives.

Globally, AI governance frameworks are also emerging. Companies that build compliant and secure systems may gain a competitive advantage as regulations tighten.

Even transformative technologies involve uncertainty. Investors should keep these factors in mind:

Execution complexity

Deploying advanced AI across enterprise systems requires integration expertise and client education.

Adoption timelines

Large organizations often adopt new technology gradually, which can delay revenue realization.

Cost pressures

Initial investments in infrastructure and talent can affect margins before scale benefits appear.

Balanced evaluation helps investors distinguish hype from sustainable opportunity.

The collaboration signals strategic foresight rather than immediate financial impact. Over the next few years, success will depend on how effectively AI solutions translate into signed deals and recurring revenue streams.

If implemented well, agentic AI could become as transformative for IT services as cloud computing was a decade ago. Companies that lead early in such transitions often secure long term competitive advantages.

Major technology shifts rarely happen overnight. They unfold through phases such as pilot projects, enterprise adoption, and large scale deployment. Monitoring contract wins, client case studies, and management commentary can provide valuable insight into progress.

Research driven platforms like Swastika Investmart help investors interpret such developments through data backed analysis, strong support, and structured insights. Having access to reliable research tools can make a meaningful difference when evaluating emerging themes like AI led transformation.

What is the main goal of the TCS OpenAI collaboration

The partnership aims to build advanced AI driven enterprise solutions that can automate complex business processes and improve efficiency.

Will agentic AI affect IT sector jobs

It may change job roles rather than eliminate them. Demand could rise for AI specialists, data engineers, and solution architects.

Is this positive for TCS stock long term

Potentially yes if the company successfully converts AI capabilities into large contracts and revenue growth.

How does this affect Indian IT industry competitiveness

It strengthens India’s position as a technology innovation hub and may encourage other firms to accelerate AI adoption.

Should investors act immediately on such news

Not necessarily. Long term investment decisions should be based on financial performance, execution progress, and valuation analysis.

The entry into agentic AI through collaboration with OpenAI reflects a forward looking strategy that aligns with global technology trends. It signals that the next phase of growth for IT services may be driven by intelligent systems capable of delivering measurable business outcomes. For investors, this development is worth tracking as it could shape the future trajectory of both the company and the broader sector.

If you want professional insights, research backed analysis, and a reliable investing platform to track such opportunities, you can start here:

4

Hindustan Unilever Limited has unveiled a ₹2,000 crore capital expenditure plan focused on capacity expansion, technology upgrades, and supply chain optimization. For a consumer goods giant known for steady performance rather than aggressive spending, this decision stands out.

Capex announcements from large FMCG companies often signal confidence in future demand. Unlike cyclical sectors, consumer goods investments are typically driven by real consumption trends rather than speculation. That makes this move particularly relevant for investors tracking India’s economic momentum.

India’s consumption story has evolved in recent years. Urban demand remains strong, but rural markets are showing renewed traction after periods of slowdown. Higher government spending, improving farm incomes, and infrastructure development have supported rural purchasing power.

For a company deeply embedded in daily household consumption, expanding production capacity allows it to meet demand spikes without supply constraints.

Consumers are increasingly shifting toward premium products such as specialized skincare, health focused foods, and high quality personal care items. Premium segments often carry better margins than mass market goods. Investing in advanced manufacturing facilities helps companies produce these higher value products efficiently.

Although detailed allocation may unfold gradually, analysts expect funds to be deployed across three major areas.

New plants or expanded lines can increase output in high demand categories. This is especially important for fast moving products where stock shortages directly impact sales.

Modern factories rely on robotics, data analytics, and predictive maintenance systems. Automation reduces errors, lowers labor intensive costs, and improves consistency. Over time, this supports margin expansion.

Efficient logistics networks help companies reach remote markets quickly. Investments in warehouses and digital supply chains can cut transportation costs and reduce delivery time.

Capex announcements often influence stock sentiment because they reflect management’s outlook. A company willing to invest heavily typically expects demand visibility over several years.

For equity markets, such moves can have ripple effects:

However, investors should remember that capex initially increases expenses. Returns emerge gradually as facilities become operational.

Consider how beverage companies expanded bottling plants during periods of rising demand. Those investments allowed them to scale quickly when consumption surged during peak seasons. Firms that delayed expansion often struggled with stock shortages and lost market share.

The same principle applies here. By investing ahead of demand, companies position themselves to capture future growth rather than reacting late.

India’s manufacturing ecosystem is increasingly supported by policy initiatives that encourage domestic production. Incentives for local manufacturing, simplified compliance processes, and infrastructure development have improved the ease of doing business.

The presence of strong oversight by regulators such as the Securities and Exchange Board of India also strengthens investor confidence. Transparent disclosures and governance standards help shareholders evaluate whether capital allocation decisions are prudent.

Even well planned expansions carry certain risks. Understanding them helps investors make balanced decisions.

Execution risk

Project delays or cost overruns can reduce expected returns.

Demand mismatch

If consumption slows unexpectedly, newly added capacity may remain underutilized.

Input cost volatility

Fluctuations in raw material prices can affect margins, even with improved efficiency.

Long term investors typically track quarterly updates to see whether capital expenditure translates into revenue growth and operating leverage.

Large scale investments by market leaders often set industry trends. Smaller competitors may follow with their own expansion plans to remain competitive. This can trigger a broader investment cycle across the sector.

It also signals confidence in India’s structural consumption growth. When companies that closely track household spending increase investments, it often reflects strong ground level demand indicators.

For investors, this announcement highlights an important principle. Sustainable wealth creation often comes from businesses that reinvest profits into growth. Capex funded expansion, when executed well, can drive earnings compounding over many years.

That said, investment decisions should always be supported by research rather than headlines. Evaluating balance sheets, return ratios, and management commentary provides a clearer picture of whether a company’s expansion plan is likely to succeed.

Platforms such as Swastika Investmart help investors interpret such developments through detailed research tools, responsive support, and investor education resources designed for both beginners and experienced market participants.

What does HUL’s ₹2,000 crore capex indicate

It suggests the company expects sustained demand growth and is preparing capacity in advance to meet future consumption.

Will this investment impact profits immediately

Short term profits may remain stable or slightly pressured due to spending, but long term gains depend on execution and demand realization.

Which sectors benefit from such capex plans

Capital goods, logistics, packaging, and industrial equipment suppliers often benefit from large manufacturing investments.

Is capex always positive for stocks

Not necessarily. It is positive when returns exceed cost of capital. Investors should track utilization and profitability metrics.

Does this reflect broader economic strength

Yes. Large consumption driven investments often signal confidence in economic stability and purchasing power trends.

The ₹2,000 crore expansion plan is more than a financial commitment. It is a strategic statement about future growth, demand visibility, and long term confidence in India’s consumption engine. For investors, such developments serve as valuable indicators of where corporate India sees opportunity.

If you want expert backed insights and research driven analysis to track opportunities like this, you can start your investment journey here:

Trust Our Expert Picks

for Your Investments!