Global oil markets are once again in focus. Oil prices steady near key levels as former US President Donald Trump indicated he prefers a nuclear deal with Iran, even while warning of consequences if talks fail.

At present, West Texas Intermediate is hovering near $66 per barrel, while Brent crude is holding below $72.

For investors, traders, and policymakers, this is not just another commodity headline. It could shape inflation trends, currency movement, and sectoral performance in India.

Oil prices have stabilised after weeks of geopolitical tension. Trump reiterated his preference for a nuclear agreement with Iran ahead of fresh talks, but also warned it would be a very bad outcome if no deal is reached.

Currently:

The energy market is balancing two opposing forces.

Bearish factors

Bullish factors

This tug of war is why crude is stuck near key levels.

Iran is a major oil producer. Any shift in sanctions can quickly change global supply.

Geopolitical tensions have already kept crude highly volatile this year.

The biggest market fear is disruption in the Strait of Hormuz.

Why it matters:

Recent Iranian military drills in the region have already pushed tanker rates higher, showing how sensitive the market is.

Right now crude is in a technically important zone.

WTI crude

Brent crude

Until a clear geopolitical outcome emerges, crude may remain range bound but volatile.

India imports more than 80 percent of its crude oil needs, which makes oil prices extremely important for the economy.

Negative impact on:

Higher crude typically weakens the rupee and increases imported inflation.

Positive impact on:

This is why Indian equity markets closely track global crude moves.

For investors, tracking crude is no longer optional. It is a core macro variable.

This is the biggest immediate trigger. Any breakthrough could push oil lower, while a breakdown could trigger a sharp rally.

Rising shipping costs often signal tightening supply fears before prices react.

Weekly crude inventory numbers remain a key sentiment driver.

Production guidance from major producers can quickly shift the supply outlook.

For short term traders, crude is entering a headline driven phase.

Bull case

Bear case

This suggests range trading with sudden breakout risk. Long term investors should avoid knee jerk reactions and meaningfully track macro trends and sectoral impact.

In volatile macro environments like this, having the right research support matters.

Swastika Investmart stands out with:

Whether you are tracking crude linked sectors or broader market opportunities, informed decision making is critical.

Q1. Why are oil prices steady right now

Oil prices are balancing between geopolitical risk in the Middle East and hopes of a US Iran nuclear deal, keeping them range bound.

Q2. What happens to crude if the US and Iran reach a deal

A successful deal could increase Iranian oil supply and put downward pressure on global crude prices.

Q3. Why is the Strait of Hormuz important for oil markets

It is one of the world’s busiest oil shipping routes. Any disruption can significantly affect global supply and prices.

Q4. How do crude oil prices affect Indian stock markets

Higher crude raises inflation and import costs, hurting many sectors, while lower crude generally supports market sentiment.

Q5. Is this a good time to invest in oil linked stocks

Investors should remain cautious and track geopolitical developments closely, as volatility is likely to remain high.

Oil prices steady near key levels reflect a market caught between diplomacy and disruption risk. The next big move in crude will largely depend on how US Iran negotiations unfold and whether supply fears intensify.

For Indian investors, crude remains a critical macro variable influencing inflation, currency movement, and sectoral profitability. Staying informed and disciplined is essential in such uncertain times.

If you want research backed insights and a reliable investing platform, Swastika Investmart can help you navigate volatile markets with confidence.

Signatureglobal (India) Limited largest real estate development company in the National Capital Region of Delhi (“DelhiNCR”) in affordable and lower mid-segment housing. It has strategically focused on the Affordable Housing (“AH”) segment (below ₹ 4 million price category) and the Middle Income Housing (“MH”) segment (between ₹ 4 million to ₹2.5 million private-category) through GoI and state government policies.

Chairman and Whole time Director of the Company. He has over eight years of experience in real estate industry. He has been appointed as a director on the Board of the Company since November 2, 2017.

Vice Chairman and Whole-time Director of the Company. He has an experience of over seven years in the real estate sector. He has been appointed as a director on the Board of the Company since February 15, 2022.

Managing Direct of the Company. He is a fellow member of the Institute of Chartered Accountants of India. He has over nine years of experience in the real estate industry. He has been appointed as a director on the Board of the Company since November 5, 2015.

Company Secretary and Compliance Officer of the Company. He joined the Company on May 2, 2022.He has been admitted as a fellow at the Institute of Company Secretaries of India since November 13, 2011.

Chief Financial Officer of the Company. He joined the Company on October 17, 2016. He holds a bachelor’s degree in commerce (honors) from the University of Delhi. He has been admitted as an associate member of the institute of chartered accountants of India.

Chief Executive Officer of the Company. He joined the Company on February 1, 2020. He holds a bachelor’s degree in commerce from the University of Delhi and has passed the final examination conducted by the institute of chartered accountants of India.

%252C.webp)

%252C.webp)

Signature Global is the largest real estate player in Delhi, NCR, operating in affordable and lower-mid-segment housing. It is a well-known brand with a strong distribution network. The company also has large projects on hand.

But it has been a loss-making business for the last few years. Secondly, its major business is focused on a limited region. Changing government policies may also impact its business adversely.

As it has been at a loss, we cannot define its P/E valuation; however, its discounted revenue multiple is 3.48x, which is lower than the industry average. However, due to its current financial condition and other risk factors, we will avoid this IPO.

The information contained herein are strictly confidential and are meant solely for the information of the recipient and shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written permission of Swastika Investmart Ltd. (“SIL”). The contents of this document are for information purpose only. This document is not an investment advice and must not alone be taken as the basis for an investment decision. Before taking any decision to invest, the recipient of this document must read carefully the Red Herring Prospectus (“RHP”) issued to know the details of IPO and various risks and uncertainties associated with the investment in the IPO of the Company. All recipients of this document must before acting on the given information/details, make their own investigation and apply independent judgment based on their specific investment objectives and financial position. They can also seek appropriate professional advice from their own legal and tax consultants, advisors, etc. to understand the risks and investment considerations arising from such investment. The investor should possess appropriate resources to analyze such investment and the suitability of such investment to such investor’s particular circumstances before making any decisions on the investment. The Investor shall be solely responsible for any action taken based on this document. SIL shall not be liable for any direct or indirect losses arising from the use of the information contained in this document and accept no responsibility for statements made otherwise issued or any other source of information received by the investor and the investor would be doing so at his/her/its own risk. The information contained in this document should not be construed as forecast or promise or guarantee or assurance of any kind. The investors are not being offered any assurance or guaranteed or fixed returns on their investments. The users of this document must bear in mind that past performances if any, are not indicative of future results. The actual returns on investment may be materially different than the past. Investments in Securities market products and instruments including in the IPO of the Company are highly risky and they are generally not an appropriate avenue for someone with limited resources/ limited investment and low risk tolerance. Such Investments are subject to market risks including, without limitation, price, volatility and liquidity and capital risks. Therefore, the users of this document must carefully consider all the information given in the RHP including the risks factors before making any investment in the Equity Shares of the Company.

Swastika Investmart Ltd or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither Swastika Investmart Ltd nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. Swastika Investment Ltd may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the Subject Company or third party in connection with the Research Report.

CORPORATE & ADMINISTRATIVE OFFICE - 48, Jaora Compound, M.Y.H. Road, Indore - 452 001 | Phone 0731 - 6644000

Compliance Officer: Ms. Sheetal Duraphe Email: compliance@swastika.co.inPhone: (0731) 6644 241

Swastika Investmart Limited, SEBI Reg. No. : NSE/BSE/MSEI: INZ000192732 Merchant Banking: INM000012102 Investment Adviser: INA000009843 MCX/NCDEX: INZ000072532 CDSL/NSDL: IN-DP-115-2015 RBI Reg. No.: B-03-00174 IRDA Reg. No.: 713.

%2520LIMITED%2520IPO.webp)

Sai Silks (Kalamandir) Limited is amongst the top retailers of ethnic apparel, particularly sarees, in south India. Through its four store formats, i.e., Kalamandir, VaraMahalakshmi Silks, Mandir, and KLM Fashion Mall as well as through e-commerce channels. It offers its products to various segments of the market including premium ethnic fashion, ethnic fashion for middle income, and value-fashion, with a variety of products across different price points, thereby catering to customers across all market segments.

OBJECTS OF THE ISSUE

Chairman & Independent Director of the Company. He has been a Director of the Company since February 18, 2022. He is a fellow member of the Institute of Chartered Accountants of India. He has approximately four decades of experience in finance sector. He is a partner at M. Anandam & Co., Chartered Accountants since 1981.

Managing Director of the Company. He is also one of the Promoters of the Company and has been associated with the Company since its incorporation. He has more than 16 years of experience in the retail sector and is responsible for the overall management, finance, internal controls and security systems of the Company.

Chief Financial Officer of the Company. He has been associated with the Company since March 1, 2022. He has been associated with the Company since March 1, 2022. He holds a bachelor’s degree in commerce from Osmania University. He is also a fellow member of the Institute of Cost Accountant of India. He has over 35 years of experience in Corporate Finance.

Company Secretary and Compliance Officer of the Company. He has been associated with the Company since November 5, 2018. He is also an associate member of the Institute of Company Secretaries of India. He has approximately 8 years of experience in secretarial work.

COMPANY PROFILE

COMPETITIVE STRENGTHS

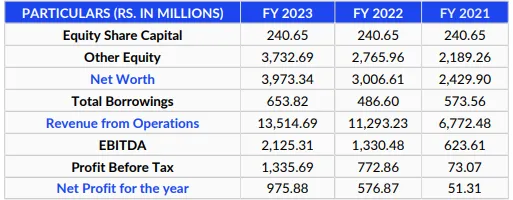

FINANCIALS (RESTATED CONSOLIDATED)

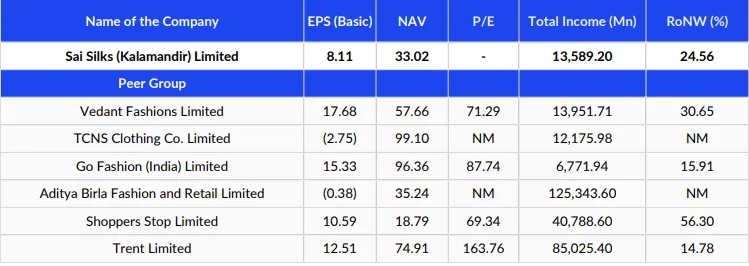

SSKL is the leading ethnic apparel retailer in the southern region of the country, with a network of 54 stores. The company has a strong presence in the offline and online markets with a track record of consistent growth and profitability. It is also strategizing to expand its footprint with a plan to set up 25 new stores.

However, concerns related to high competition, dependency on third-party vendors, regional concentration, and high cost are also there.

The issue is coming at a P/E valuation of around 27.3x, which seems fairly priced. Thus, after checking all the factors, this IPO could be considered for listing gain and long-term holding.

The information contained herein are strictly confidential and are meant solely for the information of the recipient and shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written permission of Swastika Investmart Ltd. (“SIL”). The contents of this document are for information purpose only. This document is not an investment advice and must not alone be taken as the basis for an investment decision. Before taking any decision to invest, the recipient of this document must read carefully the Red Herring Prospectus (“RHP”) issued to know the details of IPO and various risks and uncertainties associated with the investment in the IPO of the Company. All recipients of this document must before acting on the given information/details, make their own investigation and apply independent judgment based on their specific investment objectives and financial position. They can also seek appropriate professional advice from their own legal and tax consultants, advisors, etc. to understand the risks and investment considerations arising from such investment. The investor should possess appropriate resources to analyze such investment and the suitability of such investment to such investor’s particular circumstances before making any decisions on the investment. The Investor shall be solely responsible for any action taken based on this document. SIL shall not be liable for any direct or indirect losses arising from the use of the information contained in this document and accept no responsibility for statements made otherwise issued or any other source of information received by the investor and the investor would be doing so at his/her/its own risk. The information contained in this document should not be construed as forecast or promise or guarantee or assurance of any kind. The investors are not being offered any assurance or guaranteed or fixed returns on their investments. The users of this document must bear in mind that past performances if any, are not indicative of future results. The actual returns on investment may be materially different than the past. Investments in Securities market products and instruments including in the IPO of the Company are highly risky and they are generally not an appropriate avenue for someone with limited resources/ limited investment and low risk tolerance. Such Investments are subject to market risks including, without limitation, price, volatility and liquidity and capital risks. Therefore, the users of this document must carefully consider all the information given in the RHP including the risks factors before making any investment in the Equity Shares of the Company.

Swastika Investmart Ltd or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither Swastika Investmart Ltd nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. Swastika Investment Ltd may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the Subject Company or third party in connection with the Research

Report.

CORPORATE & ADMINISTRATIVE OFFICE - 48, Jaora Compound, M.Y.H. Road, Indore - 452 001 | Phone 0731 - 6644000

Compliance Officer: Ms. Sheetal Duraphe Email: compliance@swastika.co.inPhone: (0731) 6644 241

Swastika Investmart Limited, SEBI Reg. No. : NSE/BSE/MSEI: INZ000192732 Merchant Banking: INM000012102 Investment Adviser: INA000009843 MCX/NCDEX: INZ000072532

CDSL/NSDL: IN-DP-115-2015 RBI Reg. No.: B-03-00174 IRDA Reg. No.: 713.

भारत में आमतौर पर कीमती धातुओं की खरीद साल की दूसरी छह माहि में बढ़ती हुई दिखाई देती है। इस बीच, कच्चे तेल के भाव में बढ़त और सोने के इम्पोर्ट में बढ़ोतरी से भारत का ट्रेड बैलेंस -20.7 बिलियन बढ़कर -24 बिलियन हो गया है जिससे डॉलर मजबूत हो कर 83.20 रुपये पर पहुंच गया है। भारत में त्यौहार शुरू होने के पहले सोने का इम्पोर्ट इस साल अगस्त 2022 की तुलना में 40 प्रतिशत अधिक रहने का अनुमान है जिससे सोने और चांदी के भाव को घरेलु मांग का सपोर्ट भी मिल रहा है। जबकि इस साल मानसून कमजोर रहने के चलते मुद्रास्फीति को बल मिल सकता है जो सेफ हैवन मांग बढ़ा सकता है। कॉमेक्स वायदा में सोने और चांदी की कीमतों में दो हफ्तों से चल रहा दबाव फेड बैठक के पहले कम होता दिखाई दिया है। अमेरिकी कंस्यूमर और प्रोडूसर मुद्रास्फीति में हुई बढ़ोतरी मामूली रहने के चलते अनुमान लगाया जा रहा है की फेड इस सप्ताह होने वाली बैठक में ब्याज दरे नहीं बढ़ाएगा। हालांकि, बढ़ती मुद्रास्फीति पर नियंत्रण करने के लिए हॉकिश टिपण्णी, कीमती धातुओं के भाव में बढ़ोतरी की सम्भावना को सीमित कर सकती है। यूरोपियन सेंट्रल बैंक द्वारा पिछले सप्ताह मुद्रास्फीति को स्थिर करने के लिए डिपोसिट रेट में बढ़ोतरी की गई है जबकि चीन द्वारा अपनी अर्थव्यस्था को बढ़ाने और लोकल बैंक को सपोर्ट करने के लिए रिज़र्व आवश्यकता में कटौती की है, जो चांदी की ग्लोबल मांग के लिए अच्छा होगा। इस सप्ताह फेड की बैठक कीमती धातुओं के भाव को नै दिशा है।

इस सप्ताह कीमती धातुओं के भाव में सुधार रहने की सम्भावना है। एमसीएक्स अक्टूबर वायदा सोने में सपोर्ट 58000 रुपये पर है और रेजिस्टेंस 59700 रुपये पर है। दिसंबर वायदा चांदी में सपोर्ट 70000 रुपये पर है और रेजिस्टेंस 74000 रुपये पर है।

Zaggle Prepaid Ocean Services Limited is a leading player in spend management with a diversified offering of fintech and SaaS products and services to corporates. Their SaaS platform is designed for (i) business spend management (including expense management and vendor management); (ii) rewards and incentives management for employees and channel partners; and (iii) gift card management for merchants, which they refer to as customer engagement management system (CEMS).

...png)

Executive Chairman of the Company. He has been on the Board of the Company since April 30, 2012. He completed post graduate diploma in business management with specialisation in finance from the FORE School of Management, New Delhi. He has experience in the technology and fintech industry.

Company Secretary and Compliance Officer of the Company. She joined the Company on January 18, 2022. Prior to joining this company, she worked with Axis Clinicals Limited as assistant general manager- company secretary, Gayatri Projects Limited as assistant company secretary and Spandana Sphoorty Financial Limited as deputy company secretary and manager– corporate affairs

Managing Director and Chief Executive officer of the Company. He has been on the Board of the Company since May 7, 2012. He holds a bachelors’ degree in engineering from Bangalore University, and a masters’ degree in business administration from the University of Chicago. Prior to this, he worked as an Assistant Vice President at Citibank N.A., India.

Chief Financial Officer of the Company. He joined the Company as vice president-finance and accounts on May 9, 2022 and was promoted as the Chief Financial Officer on August 25, 2022. He is a member of the Institute of Chartered Accountants of India, New Delhi. Prior to joining this Company, he worked at Spandana Sphoorty Financial Limited.

There are no directly listed companies in India, or internationally, whose business portfolio is comparable with that of our business and comparable to Zaggle Prepaid Ocean Services Limited’s scale of operations. Hence, it is not possible to provide an industry comparison in relation to this Company.

...webp)

Zaggle Prepaid Ocean Services Limited is a uniquely positioned player in the fintech industry, offering a diversified suite of products and services. The company has a SaaS-based fintech platform and in- house-developed technology. Additionally, the company has diverse sources of revenue and a low-cost operation model.

However, there are some concerns about the company's financial performance. The company has a major dependency on third parties, and it has faced negative cash flow and a decline in its profitability in recent years. Additionally, the company operates in a highly competitive industry.

The IPO is coming at a P/E valuation of 66.6x, which is significantly higher than the valuations of its listed peers. The company's debt-to- equity ratio is also high.

Overall, we believe that the risks outweigh the potential rewards for this IPO. We would avoid investing in this IPO.

The information contained herein are strictly confidential and are meant solely for the information of the recipient and shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written permission of Swastika Investmart Ltd. (“SIL”). The contents of this document are for information purpose only. This document is not an investment advice and must not alone be taken as the basis for an investment decision. Before taking any decision to invest, the recipient of this document must read carefully the Red Herring Prospectus (“RHP”) issued to know the details of IPO and various risks and uncertainties associated with the investment in the IPO of the Company. All recipients of this document must before acting on the given information/details, make their own investigation and apply independent judgment based on their specific investment objectives and financial position. They can also seek appropriate professional advice from their own legal and tax consultants, advisors, etc. to understand the risks and investment considerations arising from such investment. The investor should possess appropriate resources to analyze such investment and the suitability of such investment to such investor’s particular circumstances before making any decisions on the investment. The Investor shall be solely responsible for any action taken based on this document. SIL shall not be liable for any direct or indirect losses arising from the use of the information contained in this document and accept no responsibility for statements made otherwise issued or any other source of information received by the investor and the investor would be doing so at his/her/its own risk. The information contained in this document should not be construed as forecast or promise or guarantee or assurance of any kind. The investors are not being offered any assurance or guaranteed or fixed returns on their investments. The users of this document must bear in mind that past performances if any, are not indicative of future results. The actual returns on investment may be materially different than the past. Investments in Securities market products and instruments including in the IPO of the Company are highly risky and they are generally not an appropriate avenue for someone with limited resources/ limited investment and low risk tolerance. Such Investments are subject to market risks including, without limitation, price, volatility and liquidity and capital risks. Therefore, the users of this document must carefully consider all the information given in the RHP including the risks factors before making any investment in the Equity Shares of the Company.

Swastika Investmart Ltd or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither Swastika Investmart Ltd nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. Swastika Investment Ltd may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the Subject Company or third party in connection with the Research Report.

CORPORATE & ADMINISTRATIVE OFFICE - 48, Jaora Compound, M.Y.H. Road, Indore - 452 001 | Phone 0731 - 6644000

Compliance Officer: Ms. Sheetal Duraphe Email: compliance@swastika.co.inPhone: (0731) 6644 241

Swastika Investmart Limited, SEBI Reg. No. : NSE/BSE/MSEI: INZ000192732 Merchant Banking: INM000012102 Investment Adviser: INA000009843 MCX/NCDEX: INZ000072532 CDSL/NSDL: IN-DP-115-2015 RBI Reg. No.: B-03-00174 IRDA Reg. No.: 713.

SAMHI Hotels Limited is a branded hotel ownership and asset management platform in India. SAMHI Hotels has a portfolio of 4,801 keys across 31 operating hotels in 14 of India's key urban consumption centers, including Bengaluru, Hyderabad, National Capital Region (NCR), Pune, Chennai and Ahmedabad, as of March 31, 2023. The company also has 2 hotels under development with a total of 461 keys in Kolkata and Navi Mumbai.

.png)

Chairman, Managing Director and Chief Executive Officer of the Company. He has been a member of the Board since December 28, 2010. He has experience in the field of hotel operations, design, consulting and investment

Executive Vice President and Head of Investments of the company. He joined the Company on February 8, 2011.

Previously, he was associated with Inter Globe Hotels Private Limited.

Senior Director - Corporate Affairs, Company Secretary and Compliance Officer of the Company. He is a member of the Institute of Company Secretaries of India and a member of the Institute of Cost and Works Accountants of India.

Chief Financial Officer of the Company. He joined our Company on December 11, 2012. Previously, he was associated with Religare Corporate Services Limited as an executive vice president finance change management

General Counsel of the Company. She joined the Company on May 2, 2017. Previously, she was associated with Phoenix Legal, Vaish Associates Advocates and Unitech Limited

.webp)

.webp)

SAMHI Hotels Limited is a branded hotel ownership and asset management platform in India. The company has a track record of successfully renovating or rebranding hotels to improve performance, and it actively pursues growth prospects through tactical mergers, acquisitions and programmatic capital investment.

SHL, is currently a loss-making hospitality company. The company's financial performance has been poor for the last three years, but it is making progress on cutting losses. But business is subject to seasonal and cyclical variations that could result in fluctuations in the results of operations.

The company is loss-making, so we do not have a P/E ratio. However, its sales multiple is 3.7X, which is below when compared to the industry average. However, as the company is in financial trouble, we won't apply for this IPO.

The information contained herein are strictly confidential and are meant solely for the information of the recipient and shall not be altered in any way, transmitted to, copied or distributed, in part or in whole, to any other person or to the media or reproduced in any form, without prior written permission of Swastika Investmart Ltd. (“SIL”). The contents of this document are for information purpose only. This document is not an investment advice and must not alone be taken as the basis for an investment decision. Before taking any decision to invest, the recipient of this document must read carefully the Red Herring Prospectus (“RHP”) issued to know the details of IPO and various risks and uncertainties associated with the investment in the IPO of the Company. All recipients of this document must before acting on the given information/details, make their own investigation and apply independent judgment based on their specific investment objectives and financial position. They can also seek appropriate professional advice from their own legal and tax consultants, advisors, etc. to understand the risks and investment considerations arising from such investment. The investor should possess appropriate resources to analyze such investment and the suitability of such investment to such investor’s particular circumstances before making any decisions on the investment. The Investor shall be solely responsible for any action taken based on this document. SIL shall not be liable for any direct or indirect losses arising from the use of the information contained in this document and accept no responsibility for statements made otherwise issued or any other source of information received by the investor and the investor would be doing so at his/her/its own risk. The information contained in this document should not be construed as forecast or promise or guarantee or assurance of any kind. The investors are not being offered any assurance or guaranteed or fixed returns on their investments. The users of this document must bear in mind that past performances if any, are not indicative of future results. The actual returns on investment may be materially different than the past. Investments in Securities market products and instruments including in the IPO of the Company are highly risky and they are generally not an appropriate avenue for someone with limited resources/ limited investment and low risk tolerance. Such Investments are subject to market risks including, without limitation, price, volatility and liquidity and capital risks. Therefore, the users of this document must carefully consider all the information given in the RHP including the risks factors before making any investment in the Equity Shares of the Company.

Swastika Investmart Ltd or its analysts did not receive any compensation or other benefits from the companies mentioned in the report or third party in connection with preparation of the research report. Accordingly, neither Swastika Investmart Ltd nor Research Analysts have any material conflict of interest at the time of publication of this report. Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions. Swastika Investment Ltd may have issued other reports that are inconsistent with and reach different conclusion from the information presented in this report. Research entity has not been engaged in market making activity for the subject company. Research analyst has not served as an officer, director or employee of the subject company. We have not received any compensation/benefits from the Subject Company or third party in connection with the Research Report.

CORPORATE & ADMINISTRATIVE OFFICE - 48, Jaora Compound, M.Y.H. Road, Indore - 452 001 | Phone 0731 - 6644000

Compliance Officer: Ms. Sheetal Duraphe Email: compliance@swastika.co.inPhone: (0731) 6644 241

Swastika Investmart Limited, SEBI Reg. No. : NSE/BSE/MSEI: INZ000192732 Merchant Banking: INM000012102 Investment Adviser: INA000009843 MCX/NCDEX: INZ000072532 CDSL/NSDL: IN-DP-115-2015 RBI Reg. No.: B-03-00174 IRDA Reg. No.: 713.

पिछले सप्ताह फेडरल रिजर्व की एक रिपोर्ट से स्पष्ट हुआ है कि जुलाई और अगस्त में श्रम बाजार में सुस्ती और धीमी मुद्रास्फीति के दबाव के बीच अमेरिकी आर्थिक विकास मामूली रहा है, जिससे उम्मीदों को बल मिला कि केंद्रीय बैंक ने ब्याज दरों में बढ़ोतरी या तो कर दी है, या इसके अंत के करीब है। फेड की बीइंग बुक के मुताबिक जुलाई-अगस्त में आर्थिक विकास माध्यम रहा है। टूरिस्म खर्चो में बढ़ोतरी हुई है, जबकि रिटेल स्पेंडिंग में लगातार गिरावट देखने को मिल रही है। मूल्य वृद्धि धीमी हुई है, लेकिन फेड सर्वे के अधिकतर जिलों ने संकेत दिया कि इनपुट कॉस्ट वृद्धि बिक्री मूल्य से कम धीमी है, क्योकि कम होती मांग के कारण व्यापार बढ़ी हुई लागत को बिक्री मूल्य में शामिल करने में असमर्थ है। लेकिन, कच्चे तेल की कीमतों में बढ़ोतरी से मुद्रास्फीति फिर से बढ़ने की सम्भावना है जिससे यह अनुमान है की फेड सितम्बर में होने वाली बैठक में अपना रुख हॉकिश रखेगा। हालांकि, अमेरिका के आर्थिक आंकड़े यह दर्शाते है की अर्थव्यवस्था की स्तिथि अभी बेहतर बनी हुई है और उम्मीद है की आर्थिक मंदी इस साल के लिए टल जाएगी जिससे सुरक्षित आश्रय की मांग कम हुई है। उधर, चीन की अर्थव्यवस्था में सुस्ती, इसके आर्थिक आकड़ो में देखि जा सकती है जिससे अमेरिकी डॉलर के विरुद्ध चीन की मुद्रा में गिरावट देखि जा रही जिससे एशिया की अन्य अर्थव्यवस्थाओं की मुद्रा भी गिरावट की चपेट में आ गई है। यूरोपियन यूनियन की मुद्रा यूरो में डॉलर की तुलना में गिरावट बनी हुई है जिससे छः प्रमुख मुद्राओ का मापक अमेरिकी डॉलर इंडेक्स, में तेज़ी देखने को मिल रही है और कीमती धातुओं के भाव में दबाव बना हुआ है। इस सप्ताह अमेरिका मुद्रास्फीति, रिटेल सेल्स, कंस्यूमर सेंटीमेंट और यूरोपियन सेंट्रल बैंक की मॉनेटरी पॉलिसी, कीमती धातुओं के भाव के लिए महत्वपूर्ण रहेंगी।

इस सप्ताह कीमती धातुओं के भाव सीमित दायरे में रहने की सम्भावना है। एमसीएक्स अक्टूबर वायदा सोने में सपोर्ट 58000 रुपये पर है और रेजिस्टेंस 60000 रुपये पर है। दिसंबर वायदा चांदी में सपोर्ट 68000 रुपये पर है और रेजिस्टेंस 75000 रुपये पर है।

Trust Our Expert Picks

for Your Investments!